Welcome to the gateway to SIBOS 2023. Explore exclusive Swift coverage, plus daily event highlights and insights geared to maximise your SIBOS experience.

The Asian Banker, Official Media Partner

SIBOS 2023

Toronto, 18 – 21 September

Articles

Top 10 takeaways from SWIFT at SIBOS 2023

Key takeaways from Sibos 2023: highlighting the importance of collaboration in addressing cross-border payment challenges, reducing...

Swift's roadmap for frictionless digital transactions and interoperability

The opening plenary at Sibos 2023 in Toronto featured insights from Swift's leadership on key financial industry trends, including...

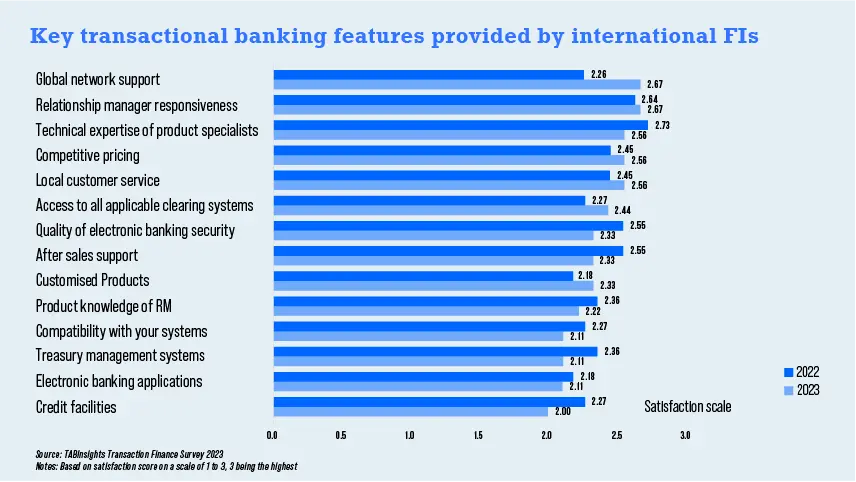

Global network support underpins collaborative finance

TABInsights’ Financial Institutions Satisfaction Survey reveals global network support as the key force in driving the future of collaboration...

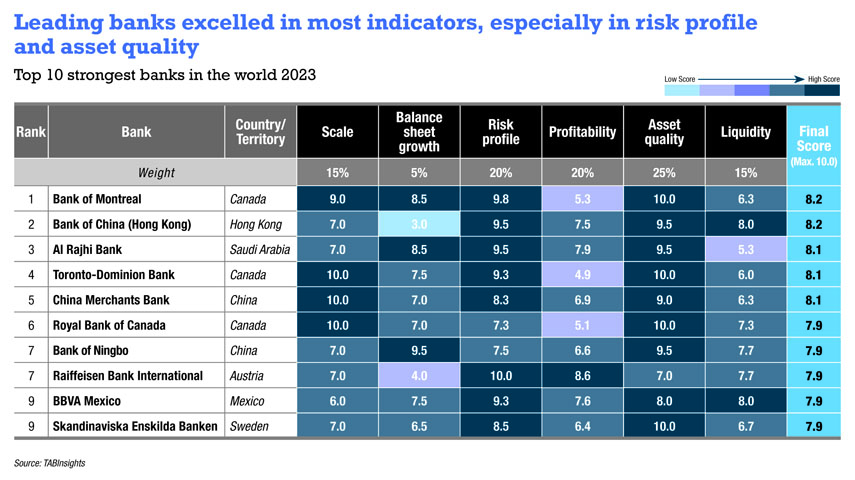

Bank of Montreal rated world's strongest for overall risk profile and asset quality

North America demonstrated the highest overall strength, followed by Asia Pacific and the Middle East...

ING to expand wholesale banking operations in APAC

The bank will expand its worldwide wholesale banking business through its Asia Pacific network, concentrating on industry knowledge, sustainability, and innovation...

NDB’s Maasdorp: “We have a 40% target for climate finance”

New Development Bank’s Leslie Maasdorp discussed how the nascent multilateral bank is bridging the gap in infrastructure financing in emerging economies...

Driving change: How banks empower corporates in sustainable financial supply chain management

Banks are playing a crucial role in guiding and empowering corporate clients in their transition through innovative solutions and collaborative efforts.....

Swift stays relevant by adopting an agnostic approach

The linchpin of cross-border finance for decades, Swift fosters innovation through collaborations and experiments with central banks.....

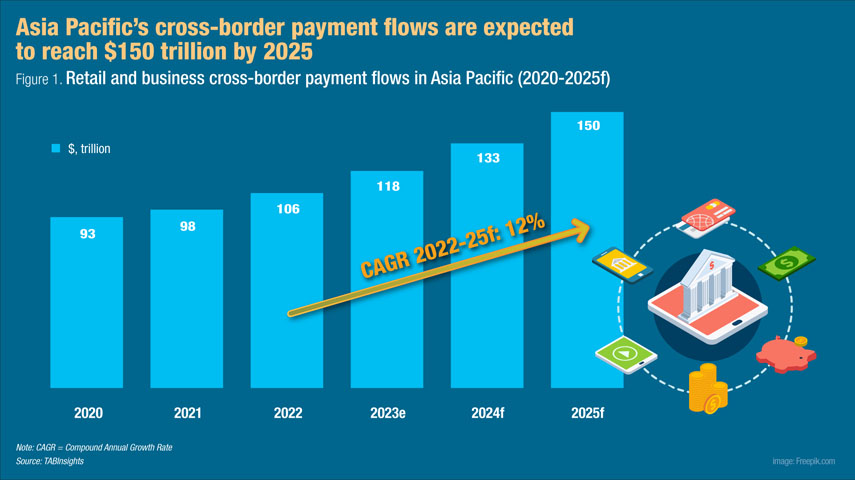

Advancing payment integration and connectivity in Asia: A collaborative approach

Asia has banded together to improve cross-border payment integration, connectivity, and interoperability for faster, cheaper, and more inclusive transactions, aided by initiatives like.....

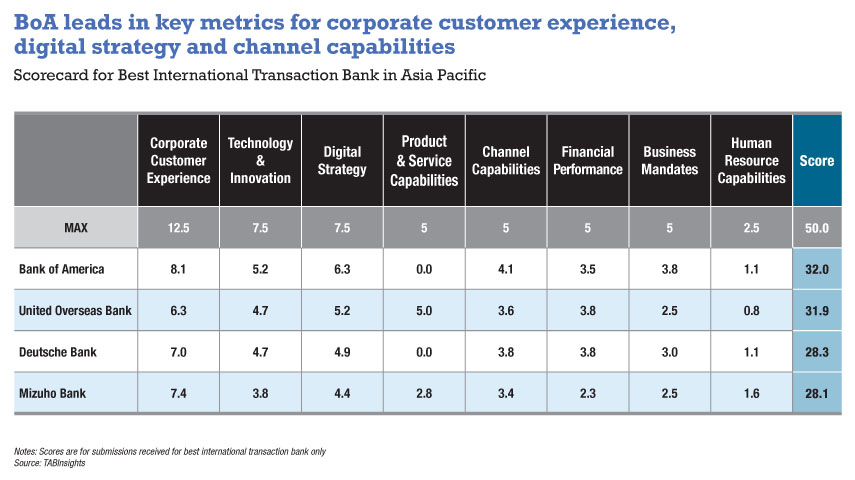

BoA, UOB and Deutsche Bank lead in transaction banking customer experience

BoA, UOB and Deutsche Bank are the winning transaction banks in Asia Pacific in The Asian Banker Best Transaction Bank Rankings 2023, with leading positions in customer experience, technology and.....

Deutsche Bank's Jan Luebke on ASEAN's Payments Revolution and ISO 20022 Adoption

The interlinking of instant payments schemes in ASEAN has brought the region to the forefront of cross-border payments, Luebke said. He also discussed.....

Deutsche Bank accelerates correspondent banking and RMB payments

Niger Lau, head of institutional cash and trade in Greater China at Deutsche Bank discusses how multilateral initiatives such as Belt and Road Initiative (BRI) and Regional Comprehensive Economic Partnership .....

Trends in global cross-border payments

Sebastien Avot, regional head, institutional cash and trade and distribution in Asia Pacific at Deutsche Bank emphasisesISO 20022's crucial role in cross-border payment efficiency and the role Deutsche Bank .....

Generative AI for transforming financial services: Revolutionising decision-making processes

Generative AI is emerging as a game-changer, with new developments from the most promising companies in the field pushing its use.....

Asia Pacific Financial Institutions Satisfaction Survey

The Asia Pacific Financial Institutions Satisfaction Survey 2023 gauges the efficacy of international transaction banks in meeting the needs of both regional......

Publications

The annual definitive ranking and survey of The World's Largest and Strongest Banks

The TAB Global 1000 World’s Strongest Banks ranking evaluates the 1000 largest banks in the world based on their strength. This ranking employs a detailed and transparent scorecard to assess banks using six criteria related to balance sheet performance: scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity, encompassing 14 specific factors. This year represents a significant milestone as the ranking has expanded to include 1000 banks and financial holding companies from across the globe, evaluating their performance for the financial year (FY) 2022, with a cutoff date in March 2023.

Preview

The Leadership Achievement Edition Recognising Visionaries in Finance

This edition spotlights influential leaders shaping the global financial landscape—the annual Leadership Achievement Awards pay tribute to titans of the industry who dare to breach conventions. The publication also covers the Future of Finance Summit 2023, including events like the Financial Technology Innovation Conference and CEO Leadership Dialogue. Keynotes by illustrious industry pundits Howard Davies and Barney Frank offer critical takeaways.

The feature story explores how banks guide sustainable financial supply chain management for corporate clients, emphasising collaborative solutions for enduring profitability and societal benefits.

The Transaction Finance Working Group

The Transaction Finance Working Group is a membership-based research programme for decision-makers in the transaction and corporate banking industry.

As your corporate and business customers navigate the complexities of the post pandemic "new normal", it is now more important than ever to learn sustainable and innovative strategies and be able to foresee the future roadmap of your peer transaction banks, as you complete for the customers' wallet share across cash and treasury management, trade and supply chain finance, and payment services.

Videos

Reducing APAC cross-border payments friction points with pre-validation in Swift Go

Julie Bolan, head of payments for APAC at Swift discusses the adoption of Swift Go and payment pre-validation in Asia Pacific. She elaborates on the resulting enhancement in customer experience in cross-border payments. Bolan also emphasises the role that Swift Go plays in delivering low-cost and transparent cross-border payments, and the value that beneficiaries receive.

Temenos' Fennel: "Automating payments and collaborations, will meet customer expectations"

Mick Fennell, the business line director of payments at Temenos discusses the significant opportunities and challenges in the payments industry, emphasising the dynamic nature of payments, particularly in Asia Pacific, which is leading in digitalisation.

StanChart's Fehr: "There is a gap for sustainable trade loan products"

Kai Fehr, the global head of trade and working capital at Standard Chartered Bank, discussed the recent launch of the bank's sustainable trade loan product. He likened the product to refinancing in a Swift trade loan that is issued to #financial institutions (FIs) but in a sustainable format.

John Mitchell

John Mitchell, CEO and co-founder of Episode Six, discussed the future of instant payments and the increased demand for virtual B2B payments in Asia Pacific. Mitchell also shared how ISO20022 is laying the foundation for efficient and faster payment processing across multiple connections, institutions, and markets.

Finastra launched cloud-native solution for instant cross-border payments

Arun Kini, managing director for payments in Asia Pacific at Finastra discussed the evolving landscape of instant payments in Asia Pacific. He highlighted that the region has been a leader in instant payments, with the emergence of a second wave of immediate payments, including domestic schemes and bilateral connectivity between instant payment schemes. This presents challenges for banks, particularly those relying on legacy systems that don't support ISO20022 or 24/7 operations. From a business perspective, cross-border realtime payments bring additional challenges, such as dealing with foreign currency (forex) exchange rates, liquidity, and the need for fraud checks. Finastra has been working on solutions to help banks address these challenges, including offering cloudnative ISO 20022 products, assisting with liquidity and forex management, and launching compliance-as-a-service in collaboration with fintechs to address regulatory and anti-fraud requirements. He said Finastra's focus is on providing solutions that go beyond payment capabilities to address the specific needs of various segments, including retail, small and medium-sized enterprises (SMEs), and large corporates, each with its own set of challenges. It aims to support customers in navigating these dynamic changes in the payments market.

Bank of America digitises trade and supply chain transactions to reduce mechanical issues

Geoff Brady, head of global trade and supply chain at Bank of America, described the recent launch of its CashPro Supply Chain Solutions as the initial steps of the bank's trade and supplychain transformation journey.

Rachel Whelan

Rachel Whelan, APAC Head of Corporate Cash Management & Global Head of Payments & Transactional FX Product Management, at Deutsche Bank discussed the impact of tightening cash cycles on corporate cash and liquiditymanagement, as well as the evolution of the bank's solutions to meet customers' dynamic needs.

Temenos study: "AI is the pivotal factor that will shape the industry"

Kanika Hope, chief strategy officer at Temenos discussed key findings from a commissioned survey of 300 senior bankers across different business lines in the industry.

Domestic Instant Payments increased the demand for faster cross-border transactions

Philip Panaino, Global Head of Cash Management, and David Rego, Global Head of Payments at Standard Chartered Bank spoke of interesting times for the transformation of payments. Panaino characterised this fundamental shift as a game-changer with the potential to deliver greater value to the industry.

StanChart utilises blockchain and tokens to improve supply chain finance experience

Samuel Mathew, group head of flow and financial institution trade at Standard Chartered Bank discussed the bank's trade and supplychain digitalisation initiatives.

Bottomline Technologies' Shoshani: "APAC banks struggle with visibility and speed"

Eli Shoshani, head of financial messaging for Asia Pacific at Bottomline Technologies, shared insights from its commissioned global competitive payments and banking survey. He highlighted issues that banks, especially in Asia Pacific, grapple with in their day-to-day operations and how these factors impact their ability to stay competitive.

Shekhar Bhandari

Shekhar Bhandari , president of global transaction banking at Kotak Mahindra Bank highlighted three major themes from Sibos 2023. Firstly, he emphasised the importance of security and risk management, and the integration of advanced technologies like AI artificial intelligence, ML machine learning, and generative AI to enhance risk management and data security.

Trade Ledger utilises OpenAI to address data processing, and data fragmentation in cash-to-cash cycle

Martin McCann, founder of Trade Ledger™ a lending technology company established in 2016 that supports the digitisation of lending products for businesses, discusses the potential of OpenAI's large language model to address the insights SMEs can gain from their data. These firms often lack the resources or in-house expertise to access and comprehend information needed to optimise the cash-to-cash cycle.

Machine learning and AI will modernise corporate and consumer banking

Richard Harmon, global head of financial services, and Arvind Swami, director for financial institutions for Asia Pacific at Red Hat, discussed the -digital transformation of transaction and corporate banking.

John Kirkpatrick

John Kirkpatrick, head of custody product at Broadridge discussed the operational console designed to enhance custody services through data exchange.

Matthew Van Niekerk

Matthew Van Niekerk, CEO and co-founder of SettleMint discussed how blockchain technology is reshaping the finance sector. He outlined three fundamental pillars that guide this transformation.

Distributed ledger technology's potential to boost Repo Trades

Horacio Barakat, head of digital innovation for capitalmarkets at Broadridge discussed the transformative potential of distributed ledger technology (DLT) in the repo market, which is primarily an OTC market where transactions occur directly between parties without a centralised counterparty such as an exchange.

Vinay Mendonca

Vinay Mendonca, chief growth officer for global trade and receivables financing at HSBC discussed key themes in global trade and supplychains.

ANZ's Janakiraman: "The future of payment infrastructure would be driven by tokenisation"

Hari Janakiraman, head of industry and innovation at ANZ Group, covered a spectrum of topics, from shifts in focus in transaction banking and corporate finance, next-generation payment infrastructure, advancements in the digitalisation of tradefinance, emerging commercial applications for central bank digital currencies (CBDCs) in Australia, to the future role of stablecoins in the payment landscape.

Steve Naudé

Steve Naudé, managing director for Wise Platform, and Stephen Grainger, chief executive for Americas and United Kingdom at Swift discussed the partnership between the two organisations to expand crossborder #payment options globally.